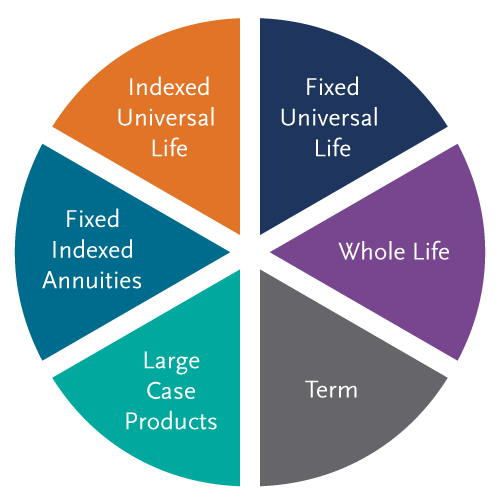

The different types of Life Insurance are:

Term Life – temporary coverage

Whole Life – lifetime coverage

Universal Life – flexible lifetime coverage

Variable Life (Caution) – could earn tax-deferred interest

Simplified Issue Life – no medical exam

Guaranteed Issue Life – no health questions or medical exam

Mortgage Protection Life – decreasing term life ins. and the face amount gets smaller over time

Final Expense Life – funeral and burial coverage

Group Life – instant issue

Joint Life

No Medical Exam Life

Accidental Death

https://www.lifeinsure.com/types-of-life-insurance/#term

------------------------------------------------------------

What is life insurance, simple definition?

Life ins. is a contract between an insurer and a policy owner. A life ins. policy guarantees the insurer pays a sum of money to named beneficiaries when the insured dies in exchange for the premiums paid by the policyholder during their lifetime.

https://www.investopedia.com/terms/l/lifeinsurance.asp

------------------------------------------------------------

What Is Health Insurance?

Health insurance is a contract between a company and a consumer. The company agrees to pay all or some of the insured person's healthcare costs in return for payment of a monthly premium.

The contract is usually a one-year agreement, during which you are responsible for paying specific expenses related to illness, injury, pregnancy, or preventative care.

KEY TAKEAWAYS

Health insurance pays most medical and surgical expenses and preventative care costs in return for monthly premiums.

Generally, the higher the monthly premium, the lower the out-of-pocket costs.

Insurance plans have deductibles and co-pays, but these out-of-pocket expenses are now capped by federal law.

Medicare, Medicaid, and the Children's Health Insurance Program (CHIP) are federal health insurance plans that extend coverage to older, disabled, and low-income people.

Health insurance agreements in the U.S. generally come with exceptions to coverage including:

A deductible that requires the consumer to pay certain healthcare costs "out-of-pocket" up to a maximum amount before the company coverage begins.

One or more co-payments that require the consumer to pay a set share of the cost for specific services or procedures.

How Health Insurance Works

In the United States, health insurance is tricky to navigate. It is a business with a number of regional and national competitors whose coverage, pricing, and availability vary from state to state and even by county.

About half of the U.S. population has health insurance coverage as an employment benefit, with premiums partially covered by the employer.

The cost to the employer is tax-deductible to the payer, and the benefits to the employee are tax-free, with certain exceptions for S corporation employees.

Self-employed people, freelancers, and gig workers can buy insurance directly on their own. The Affordable Care Act of 2010, commonly called Obamacare, mandated the creation of a national database, HealthCare.gov, which allows individuals to search for standard plans from private insurers that are available where they live. The costs of the coverage are subsidized for taxpayers whose incomes are between 100% and 400% of the federal poverty threshold.

https://www.investopedia.com/terms/h/healthinsurance.asp

------------------------------------------------------------

Send Us a Message:

Contact Us

We are committed to helping You.

Leave Us a note and We will be in touch ASAP.

163 Mallard Trail

Shepherdsville, KY 40165

jchall42@gmail.com