The Main Types of Annuities Made Easy

How to choose between fixed and variable, immediate and deferred

By CLAIRE BOYTE-WHITE Updated February 14, 2024

Reviewed by ERIC ESTEVEZ

Fact checked by SKYLAR CLARINE

Annuities are contracts sold by insurance companies that promise the buyer a future payout in regular installments, usually monthly and often for life. Within that broad definition, however, there are different types of annuities that are designed to serve different purposes. The main types are fixed and variable annuities, and payouts can be immediate or deferred.

KEY TAKEAWAYS

- A fixed annuity guarantees payment of a set amount for the term of the agreement. It can't go up or down.

- A variable annuity fluctuates based on the returns on the mutual funds it is invested in. Its value can go up or down.

- An immediate annuity begins paying out as soon as the buyer makes a lump-sum payment to the insurer.

- A deferred annuity begins payments on a future date set by the buyer.

https://www.investopedia.com/ask/answers/093015/what-are-main-kinds-annuities.asp

------------------------------------------------------------

The Purpose of Annuities

People usually buy annuities to supplement other sources of retirement income, such as pensions and Social Security benefits. An annuity that provides guaranteed income for life also assures them that even if they deplete their other assets, they will still have some income coming in.

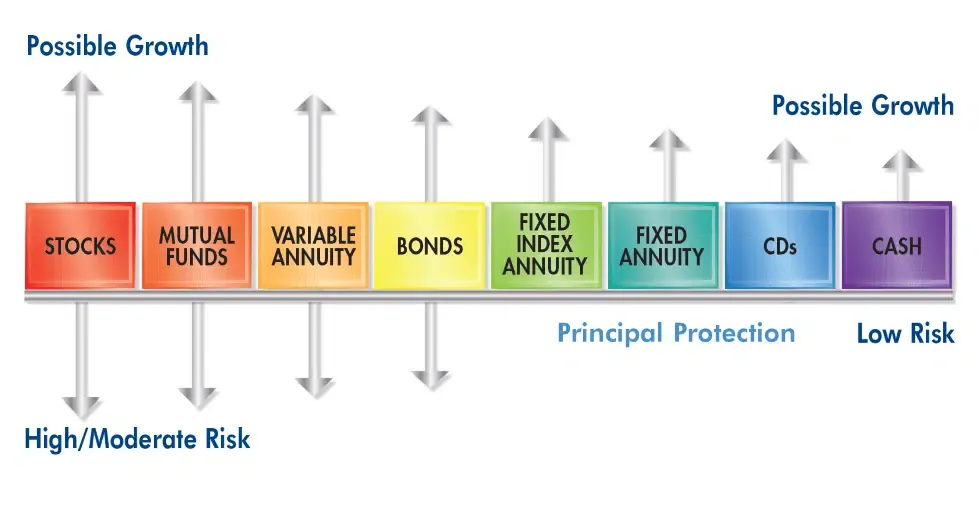

Fixed vs. Variable Annuities

Annuities can be either fixed or variable. Each type has its pros and cons.

Fixed Annuities

With a fixed annuity, the insurance company guarantees the buyer a specific payment at some future date. This might be decades in the future or right away.

In order to deliver that return, the insurer invests money in safe vehicles, such as U.S. Treasury securities and highly rated corporate bonds. While safe and predictable, these investments also deliver unspectacular returns. What's more, the payouts on fixed annuities can lose purchasing power over the years due to inflation, unless the buyer pays extra for an annuity that takes inflation into account.

Even so, fixed annuities can be a good fit for people who have a low tolerance for risk and don't want to take chances with their regular monthly payouts.

Variable Annuities (Caution)

With a variable annuity, the insurer invests in a portfolio of mutual funds chosen by the buyer. The performance of those funds will determine how the account grows and how large a payout the buyer will eventually receive.

People who choose variable annuities are willing to take on some degree of risk in the hope of generating bigger profits. Variable annuities are generally best for experienced investors, who are familiar with the different types of mutual funds and the risks they involve.

If an annuity buyer is married, they can choose an annuity that will continue to pay income to their spouse should they die first.

Deferred vs. Immediate Annuities

Annuities can also be either immediate or deferred in terms of when they begin to make payments. The basic question buyers need to consider is whether they want regular income now or at some future date. As with fixed and variable annuities, there are some trade-offs and advantages related to each type of payout timeline.

Deferred Annuities

A deferred payment allows the money in the account more time to grow. And much like a 401(k) or an IRA, the annuity continues to accumulate earnings tax-free until the money is withdrawn. Over time, that could build up into a substantial sum and result in larger payments. In annuity jargon, this is known as the accumulation phase or accumulation period.

Immediate Annuities

An immediate annuity is just what it sounds like. The payouts begin as soon as the buyer makes a lump sum payment to the insurance company. Deferred annuities and immediate annuities can both be either fixed or variable.

Additional Considerations

There are some other important decisions to make in buying an annuity, depending on your circumstances. These include the following:

- The duration of the payments. Buyers can arrange for payments for 10 or 15 years, or for the rest of their life.

- A shorter period will mean a higher monthly payment, but it also means that the income will stop coming at some point. That might make sense, for example, if the investor needs an income boost while paying off the final years of a mortgage.

- Spousal coverage. If the annuity buyer is married, they can choose an annuity that pays for the rest of their life or for the rest of their spouse's life, whichever is longer.

- The latter is often referred to as a joint and survivor annuity. Choosing the joint and survivor option generally means a somewhat lower payment, but it protects both partners, whatever happens.

What Is Better: Deferred or Immediate Payout?

The choice between deferred and immediate annuity payouts depends largely on one's savings and future earnings goals. Immediate payouts can be beneficial if you are already retired and you need a source of income to cover day-to-day expenses. Immediate payouts can begin as soon as one month into the purchase of an annuity. For instance, if you are don't require supplemental income just yet, deferred payouts may be ideal, as the underlying annuity can build more potential earnings over time.

What Are Downsides of Annuities?

While annuities provide a range of benefits—primarily a steady income to investors with customizable payout options—they have also garnered criticism over the years. Annuity sellers face scrutiny for charging high commissions to clients. Such fees can greatly increase the cost of an annuity compared to direct investment into a mutual fund.

Why Do Financial Advisors Push Annuities?

Though annuities may come with high fees or commissions, they also provide certain advantages. In particular, they provide buyers with a hands-off investment vehicle that guarantees income while requiring little oversight or management. Furthermore, if the general economy takes a turn for the worse, a fixed annuity will still provide predictable returns.

The Bottom Line

Annuities are contracts sold by insurance agents and financial advisors to clients with the promise of future payouts. Annuities come in many types. Fixed annuities guarantee set payments for their duration, while variable annuities provide payouts that can go up or down depending on the performance of the funds in which they're invested. Payouts for annuities can also be customized: Immediate annuities provide buyers with payouts fairly quickly following a purchase, whereas deferred annuities provide payouts at a later date. Each specific arrangement type comes with advantages and disadvantages, which should be weighed before making a choice.

https://www.investopedia.com/ask/answers/093015/what-are-main-kinds-annuities.asp

------------------------------------------------------------

Send Us a Message:

Contact Us

We are committed to helping You.

Leave Us a note and We will be in touch ASAP.

163 Mallard Trail

Shepherdsville, KY 40165

jchall42@gmail.com